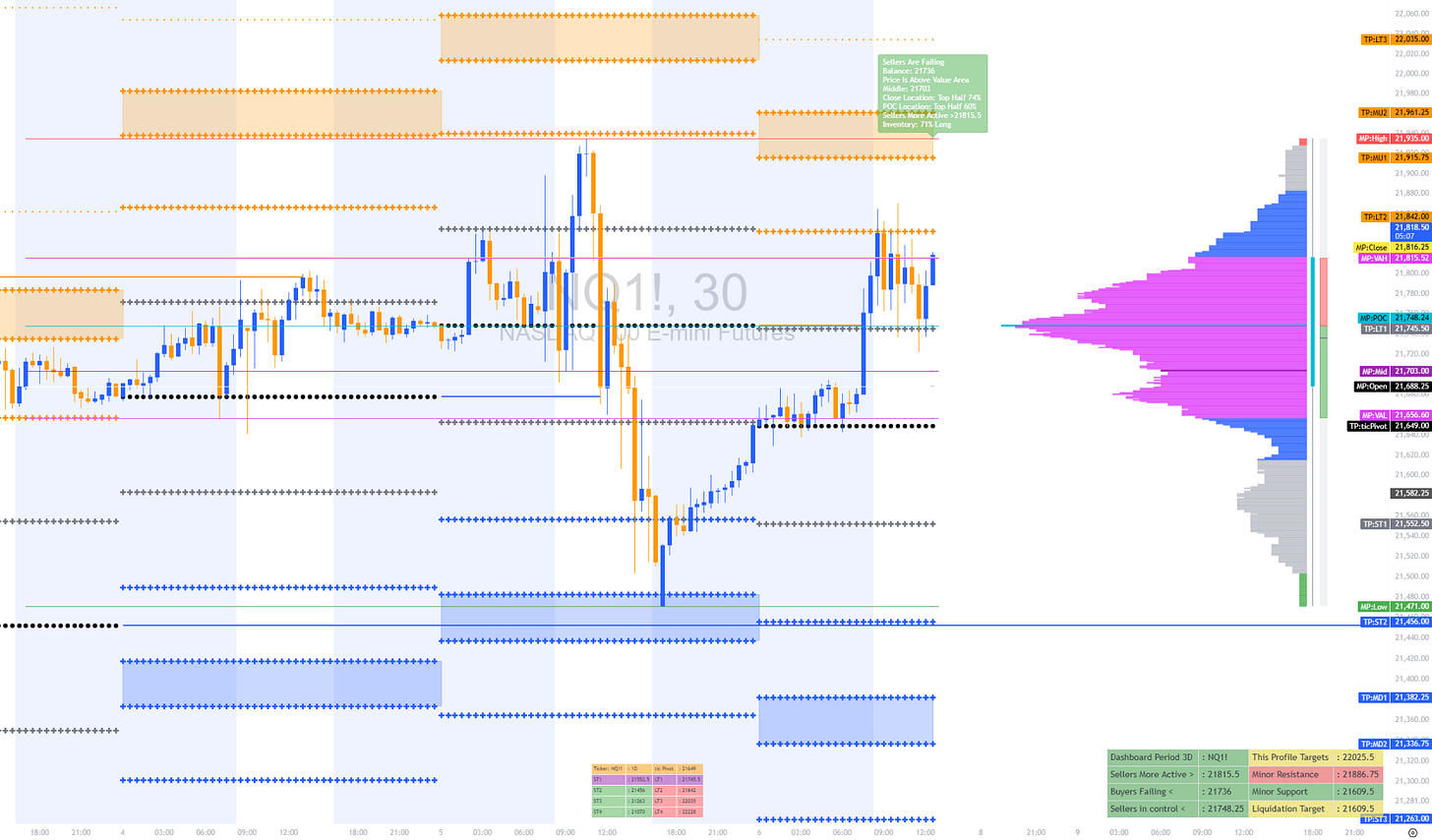

🧠 Auction Market Theory Report – NQ (Nasdaq E-mini Futures), 30-Min Chart

⚠️ Profile Integrity Note:

“Inferred from composite and session profiles; balance, excess, and POC levels used for structural interpretation.”

📍 1. What is the Market Attempting to Do?

The market is attempting to resolve a directional imbalance upward, away from the prior session’s value area, building acceptance above 21,700 with targets near the high-volume node (HVN) at ~21,815 and extension toward 22,035.

✅ 2. Is it Succeeding?

Partially. Price is currently holding above value, and the last two rotations tested into resistance but did not reject back below 21,700. However, failure to drive through 21,815.5 (Minor Resistance + Seller's Active Node) suggests buyers are testing, not dominating yet.

🧭 3. Structural Breakdown

POC: 21,748 (High in profile – bullish tilt)

Value Area High (VAH): ~21,815

Volume Profile Shape: P-shaped – short-covering structure from prior session

Support Zone: 21,685–21,700 (MP Open + Minor Support)

Target Zones:

TPx2: 21,882

TPx3: 22,035

Below support: liquidation flush toward 21,450–21,410 if invalidated

🔄 4. Behavioral / Game-Theoretic Overlay

Sellers failed to sustain the breakdown below 21,450 and were squeezed in a fast rally, evidenced by the P-shape.

Current structure shows hesitation at resistance: late longs may have weak hands if breakout above 21,815 fails again.

Game-theoretic implication: Market is in test-the-edge mode, probing for continuation above balance or a false breakout trap.

📈 5. Bias Assessment

Bias: Bullish-to-Neutral

Effort vs. Result: Buyers have shown strong effort (vertical move from ~21,400), but stalling near resistance implies the need for continuation or risk a mean reversion.

If 21,748 holds as support, upward continuation remains favored.

Sellers remain inefficient unless they can reclaim <21,700.

🎯 6. Plan of Action (Execution Logic)

Long Scenario (Pullback Entry):

Buy zone: 21,700–21,748 with tight stop below 21,685

Targets: 21,882 (TP2), 22,035 (TP3)

Breakout Fade (If trap is suspected):

Short: Failure to hold >21,815 with rejection wick

Stop: Above 21,882

Target: Reversion to 21,700, then possible flush to 21,650 or lower

🧠 7. Final Summary

The market has reversed a prior breakdown and now tests the upper end of balance. Buyers are probing for control above 21,815, but have not yet achieved full acceptance. Bias is bullish while above 21,700, but responsive selling at resistance could trigger a fade back toward the midpoint. Decision zone: 21,815.5.