Market Profile Concepts: Price & Profiles

Easy concepts to get started using market profile in your daily routine

Market Profile Concepts

Contents:

Point of Control

Price

Profile Shapes

Value Area

Introduction

“Market Profile is the best indicator I’ve found to read and understand how the market moves.”

Market Profile (MP) can be confusing at first. It is a way to view price action that many are unfamiliar with. Mainstream focuses on price at a certain time. However, it quickly becomes clear that not all prices are created equal. We cannot know if a price is good without knowing how much time has been spent there.

“Market profile focuses on time at a certain price, more specifically, the accumulation of time at a certain price.”

Prices with little time are advantageous, or “good”

Prices with a lot of time are Fair, or “bad”

The market can seem random and irrational but when organized with market profile, it becomes clear why the market moved the way it did. In this article I cover some easy MP concepts. Let us first discuss the fairest price, the Point of Control.

1. Point of Control

Price moves up and down and creates trading ranges

MP organizes the range into fair prices vs unfair prices

Price moving away from a range is an unfair, imbalanced price

Price staying inside the range is a fair, balanced price

The Point of Control (Poc) represents the “fairest” price in the range. Price has spent the most time trading at this price. The Poc is a price that buyers and sellers both agree is a fair price to conduct business. It may not be the price they want, but it’s the best price they can get at that moment.

The amount of time, in and away from balance, determines fair vs unfair.

The word fair does not carry its traditional meaning here. Opening new trades at a fair price will be choppy. Opening trades at an unfair price have little drawdowns on average. Fair refers to a balanced area in price that can support substantial amounts of trading activity. Buyers and sellers can transact as much as they need to without negatively affecting their fills. They can engage the market and adjust inventories in preparation of the next move.

Buyers and Sellers have a need to fill

Buyers and sellers engage the market because they have a need to fill. It’s not that important what the specific individual need is. There can be any number of reasons why a buyer or seller engages the market. We only need to know that buyers have a need to buy at the lowest price; sellers have a need to sell at the highest price. Participants need to buy a product and fill inventories, or they have inventory to sell.

Buyers have a need to buy at the lowest price

Sellers have a need to sell at the highest price

The Poc is always located inside the value area (I’ll discuss value area later in this article). The location of the Poc can give clues to which side is more active. Is the Poc in the higher end of range? Is the Poc in the lower end of range? The Poc tells us which side is influencing price more, buyers or sellers. It can also give clues to trending or ranging prices.

When price is trending, the Poc will shift with the trend.

Uptrends see Poc shift higher over time while downtrends see the Poc shift lower over time.

When price is ranging, the Poc will shift up and then back down, and vice versa.

Pay attention when the Poc shifts. A new Poc location means a new market condition.

Over a given time period, are buyers or sellers more active?

Low end Poc

Poc is in the lower end of value. This means buyers are more active inside the value area. Price is at risk of a liquidation any time price is below the Poc. While buyers are more active, this also means there are more long stops. Buyers get exhausted before the breakout and their stops trigger to sell. When going long inside the value area, avoid getting caught in a liquidation and play long plays above value low. The best long plays come from poor reversals or excess. More on that next time.

High end Poc

Poc is in the higher end of value. This means sellers are more active inside the value area. Sellers are vulnerable to a squeeze anytime price is above the Poc. While sellers are more active, this also means there are more short stops. Sellers get exhausted before the breakdown and their stops trigger to buy. When going short inside the value area, avoid getting caught in a short squeeze and play short plays below value high. Use the levels to invalidate the trade and avoid large drawdowns.

Low End Poc means buyers are more active

High End Poc means sellers are more active

2. Price Location

Price Above Poc

Price opening above Poc will use the value area high as resistance and the POC as support. Opening above the POC has a bullish tone to it as it’s above the fairest price traded. The tone is bullish because sellers were not strong enough to keep price below the Poc. This lack of interest from sellers are signs the market wants higher prices.

Price Below Poc

Price opening below the Poc will use the Poc as resistance and the Value Area Low as support. Opening below has a bearish tone to it as it’s below the fairest price. The tone is bearish because buyers were not strong enough to keep price above the Poc. This lack of interest from buyers are signs the markets wants lower prices.

Price Outside Value Area

An early indication price is setting up an imbalance is when price opens outside of value. Price moving outside of value is an imbalance in recent price action. This signals that price wants to continue in the direction of the imbalance. We must first always look for the imbalance to continue. It took a lot of effort for price to push outside of value. The first signs of weakness are when momentum stalls and price returns to value. Keep reading to see the Open Back in Value setup.

Price Above Value

An open above value means sellers are weak and are at risk of getting caught in a short squeeze. Price is attempting to break out of the value area and target previous range highs. This activity requires aggressive buying activity to continue the imbalance. A rejected breakout will see price trade back into value. It may take several attempts before a true breakout happens. If price is above value and struggles to get back into value, this is a strong indication there is an institution actively buying the breakout.

Price Below Value

An open below value means buyers are weak and are at risk of getting caught in a long liquidation. Price is attempting to break down the value area and target previous lows. This activity requires aggressive selling activity to continue the imbalance. A rejected breakdown will see price trade back into value. It may take several attempts before a true breakdown happens. If price is below value and struggles to get back into value, this is a strong indication there is an institution actively selling the breakdown.

Price Opens Back Inside Value

When price opens back inside the value area, there is a tendency for price to travel back thru to the opposite side of value. These are higher probability plays. It is even more likely once price crosses over the Poc. If price moving outside balance is an imbalance, then price moving back inside value is a rejection. This is a sign the value area breakout is failing. Buyers or sellers were aggressive and pushed price outside of value. However, they were too aggressive too soon and exhausted themselves. Price coming back into value is a rejection. Price trading back through value to the opposite side confirms the value area breakout failed. Price will continue failing until activity in that direction is exhausted or an institution steps in to reverse the price.

Price above Poc is bullish

Price below Poc is bearish

Price outside value is an imbalance

Price above value means short squeeze

Price below value means long liquidation

Price back inside value is a rejection of the imbalance

3. Profile Shapes

The balance of Supply and Demand influences market behavior.

Before we get into profile shapes, we must briefly mention Supply and Demand. I will go into what moves markets in another article.

Supply and Demand refers to the balance of sellers vs buyers in the market.

When Supply is high, this means there are more aggressive sellers in the market. Price moves down until the selling is balanced with buying. When Demand is high, this means there are more aggressive buyers in the market. Price moves up until the buying is balanced with selling. Traders are most aggressive when they are getting stopped out. The aggressive activity is what pushes price. Aggressive buying pushes price higher until it finds aggressive sellers. Aggressive selling pushes price lower until it finds aggressive buyers.

Price can only go up with buying and down with selling.

Common Shapes

There are four common profile shapes. The common profile shapes are Squeeze, Liquidation, Balance, and Double Distribution. Profiles have many shapes but most fall in two categories: Profiles shaped like a "b" or "p".

P shape “p” profiles are often bearish profiles. They are the result of a short squeeze. They are created at the end of the imbalance. They are bearish because they weaken markets. When the top end of a profile is wide and the bottom is thin, this means a squeeze was triggered and shorts are buying back their positions. The wider part of the profile is referred to as the “loop”. When price struggles to stay above the loop in a p-shape profile, this is an indication the short squeeze is coming to an end. Shorts are buying to cover. Price is balancing because the buying is getting exhausted. The upwards move is stalling because an institution is also selling. When the shorts are all squeezed out and there is no one left to buy, price will reverse and fall. There is no more buying so the auction has to move lower to attract participation.

b shape “b” profiles are often bullish profiles. They are the result of a buyer liquidation. They are created at the end of the imbalance. They are bullish because they strengthen markets. When the bottom end of a profile is wider than the top, this means a liquidation was triggered and longs are selling their positions. The wider part is referred to as the “loop”. When price struggles to stay below the loop in a b-shape profile, this is an indication the liquidation is coming to an end. Price is balancing because the selling is getting exhausted. The downwards move is stalling because an institution is also buying. When the longs are all liquidated and there is no one left to sell, price will reverse and rally. There is no more selling so the auction has to move higher to attract participation.

D shape “D” profiles are balanced profiles. Activity above and below the Poc are about equal. Neither side has control of price. D shape profiles are associated with ranging activity. Price is pausing before making the next move. During this pause, inventory is adjusted, and participants test the trading range for strength and weakness. D shaped profiles are also considered balanced profiles. Price will test the highs to gauge seller interest. Price will test the lows to gauge buyer interest. Price is balancing and testing to find where the most stops have accumulated. One clue to the next direction is volume. High volume in a balance area implies absorption before a reversal. Low volume in a balance area implies consolidation before continuation of the previous direction. More on this in another article.

B shape “B” profiles are double distribution profiles. These profiles often occur near major price reversals and swings. They are the result of price trading above and below value. The purpose here is to hunt stops. A large institution is engaging the market and influencing price. They want cheap entries and fills so they manipulate price and sentiment to trap unsuspecting traders. More on price traps and orderflow vacuums in another article. The institutional activity swings price wildly and catches the crowd off balance. Once one side is stopped out, price often whiplashes to the opposite side and continues on a new trend.

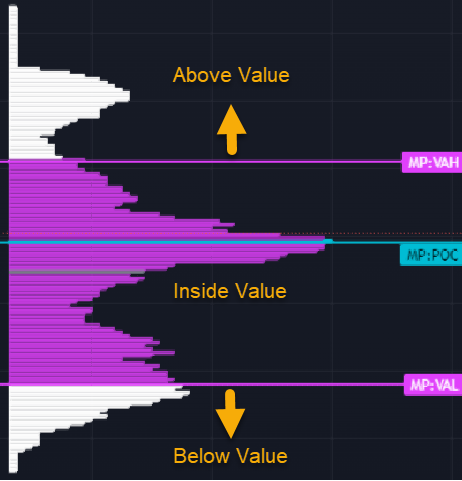

4. Value Area

The value area is simply the area where 70% of the trading occurred, or simply most of the trade activity. Look at any chart and you see will that price tends to congregate in this area. Time spent inside value area will either be accumulating or distributing activity. I will discuss accumulation vs distribution in another article. For now, focus on time spent outside of value. The time spent above and below are outliers. It is here where we determine what an advantageous price is for the Longer Term traders.

Market participants will see that time is valuable outside the value area.

When competition is high, price will spend little time outside of value. Strong competition to buy will see price spend little time below value. Prices will rise higher and higher. It will be increasingly difficult to find lower prices to buy. Strong competition to sell will see price spend little time above value. Prices will fall lower and lower. It will be increasingly difficult to find higher prices to sell. When interest is lacking from both sides, price will range inside value, waiting for a large market participant to tip the balance. When interest is lacking from buyers, it will be easy to find lower prices to buy. When interest is lacking from sellers, it will be easy to find higher prices to sell.

Longer term traders seek an advantageous price

Shorter term traders seek a fair price

Price spends most of the time ranging inside the value area. The fairest price will always be inside the value area. Because of this, the value area is for traders seeking a fair price. Short term traders seek a fair price, so most of the activity in the value area are from short term traders. When the Longer Term trader enters the value area, he loses his edge and leaves footprints. When he buys, he pushes price up, above the fair price. This shuts off a substantial portion of buying activity. The result is activity above the fair price will be minimal. Shorter Term traders have now stopped buying. They no longer perceive it to be a fair price.

Longer Term traders will buy at any price.

Shorter Term traders will not buy above the fair price.

They only want to buy below the fair price. They do not have the luxury of time to chance that price will continue higher. So instead, they perceive price to be too high and sell or short. This pushes the price down. Shorter Term traders will keep pushing down past the fair price because they are unsure of where value is. The selling activity continues until a Longer Term Buyer responds. When price is below the fair price, he will respond and start buying again. His activity triggers a short squeeze and price moves back up. When he buys above fair price he is initiating and buying higher. This continues until he is done, or price moves up high enough to attract a Longer Term Seller.

The key takeaway with value area is that Longer Term traders are responsible for direction; Shorter Term traders are responsible for finding the fair price.

Shorter Term traders are backward price influencers

Longer Term traders are forward price influencers.

Have you ever had that urge to act when price is too high, and you must short; or price is too low, and you must buy? That means you were a backward price influencer. If you ever felt that price was continuing higher or price was continuing lower, that means you were a forward price influencer. The relationship between Shorter/Longer Term traders and backwards/forwards price influencers determines the shape and the distribution of time in the profile.

These concepts should get you started. The more you use market profile, the easier it is to understand it. I always use market profiles on 30min charts first. I use 30 min charts and set the profile to daily or weekly. You can use other chart periods, but don’t sporadically switch between them. Use chart periods in appropriate market conditions. Sometimes a market is fast, and a lower chart period will update faster. Faster markets need faster updates because of fast changing conditions. Sometimes a market is slow, and a lower chart period only increases the noise. Fast updates are not needed. Compare other chart periods to the 30min chart period. 30min charts are the baseline to make comparisons. There is a lot of information packed into this article. I will have more articles covering some more of the nuanced topics in-depth.

Subscribe to this free newsletter and make sure you don’t miss out on future articles! Leave some feedback in the comments section. Let me know what you think or if you want more content like this!

Excellent!

Awesome Bro! Thanks! Appreciate the content. -StepStoneTrader